Last week was so eventful that this week has been all about sleeping, hydrating, and cuddle sessions with my daughters.

One of the highlights of attending Hispanicize was to have the great honor to represent Prudential as a brand ambassador, for the second year in a row.

The summit was an experience like no other for multicultural digital influencers and entrepreneurs, as well as renowned Hispanic celebrities.

As part of this event, I had my debut as a model for the “Finance meets Fashion” show, organized by Latina Magazine.

It was such a unique experience, which gave me a richer perspective of what the job of a fashion model entails.

It was also really fun “to strut my financial stuff,” in a gorgeous and modest designer dress.

The Positive Impact Awards highlights ordinary people who endeavor to achieve extraordinary community change and contribution.

It was an emotional ceremony in which we witnessed the passion and heart of five change agents, four of which were nominated.

After inspiring the room with his work, Dante Alvarado was selected as Person of the Year.

His acceptance speech was cause for many sobs and tears, so my eyes were swollen when we chatted and took a selfie.

I was also a little sweaty from dancing to gorgeous JenCarlos Canela’s jams.

My friends and I visited the Prudential lounge, and had a blast playing a game of #Prupárate, a spinoff Jeopardy, which I won, by the way! LOL

My favorite moment of all though, has to be when LaToyia and I were able to share our stories and our financial tips for moms achieving financial success.

As her coach and friend, I am honored to share this passion to equip moms with the tools to create a fulfilling life.

My mission includes empowering moms with financial solutions, so they can make the right decisions for themselves and their families.

I know first hand the pain and consequences of not being ready for unforeseen circumstances and how hard it is to overcome unexpected financial obstacles.

I found myself a single mom with no emergency fund, and that’s when I realized that a man is not a plan.

It doesn’t have to be divorce for you like it was for me; it could be an emergency, an accident, health or dental expenses, sudden car or home repairs… you name it.

Being a positive mom means you hope for the best, but you also prepare for the worst.

I learned the hard way that, as moms, we must strive for financial security so we can enjoy greater peace of mind in the present, be prepared for the future, and build a legacy for our posterity.

Experts recommend to set aside at least 4-6 months worth of expenses.

What came to your mind when you read that?

I don’t know how to save that much.

I can’t afford to save that much.

I don’t need to save that much.

If that’s you, you’re not alone. Research shows that 25% of Americans have no emergency savings in place at all. And it’s time to change that!

There are some steps you can take today to build your emergency fund, a safety net for rough financial times – the times of the seven skinny cows, as I like to call it.

1. Pay Down Your Debt

In order to get out of debt you need to know how much debt you actually have and start a plan to pay it off. As you become debt free, you will have more room in your budget to save.

But don’t wait until your debt is fully paid off to start saving. Prudential advices to use half of your available funds to pay down your highest-interest debt (most likely credit cards) then send the other half into an emergency account.

“Continue doing that until you pay off the card or loan, then go to the next highest-interest debt, and so on.“

Because I grew up in poverty and the practice of saving helped me become financially secured, I know that you are never too poor to save, just as your income is never too low to speak with a financial advisor to help you build wealth.

2. Track Your Spending

Tracking everything you spend will help you see your spending patterns and organize yourself around finances. A monthly budget is your best ally in helping you achieve your financial goals.

Sometimes we feel tempted to buy something impulsively, without assessing first whether it is a real need or a simple want.

When we study our purchases, rather than caving into instant gratification, use discretion in our spending and become smarter consumers, we can impact our financial preparedness and financial future a great deal. Every penny counts.

I always ask myself whether I see my purchase as an investment: having a new handbag to show off is different than going to Yoga, or getting a massage, because these last two contribute to your sanity, your physical wellbeing, and your spiritual wellness.

With that being said, I did cancel my membership to the Yoga Studio, because I don’t need $130 deducted monthly from my checking account, just to go a couple of times a month, which is what I can realistically do with my travel schedule. YouTube videos are free and I can access them anytime!

Eating at home, rather than eating out is one of the best ways to save money for most families in the United States.

You will be surprised by how much you can add to your emergency fund and how much of healthier alternative it is, which will save you in doctor visits and meds. Plus, it promotes family togetherness, which is absolutely priceless.

Parents in the U.S. spend an average of 7 minutes per week having meaningful conversations with children, so you can count yourself out of that statistic by going grocery shopping with your kids, involving them in meal planning and food preparation, and eating at the table with them.

If you are serious about building your emergency fund, you can think of things you can cut down on. For example, I do not subscribe to cable TV, and we are conscious about saving water and electricity to reduce those bills each month – and save the Earth!

It adds up, loves… Like Benjamin Franklin says, we must beware of little expenses, because a small leak can sink a big ship. But the good news is that it’s up to you whether you want it to add up in your favor.

This is not to say you will live in complete austerity. Feeling deprived is counterproductive and can even cause depression, because of everything you juggle as a mom. The key is to spend with your financial wellness in mind and to seek professional help so you know you’re on the right track.

3. Automate Your Savings

It is paramount that a savings amount is allocated into your monthly budget or spending plan, just like your other bills and expenses.

Having a system and sticking to it is the best way to save.

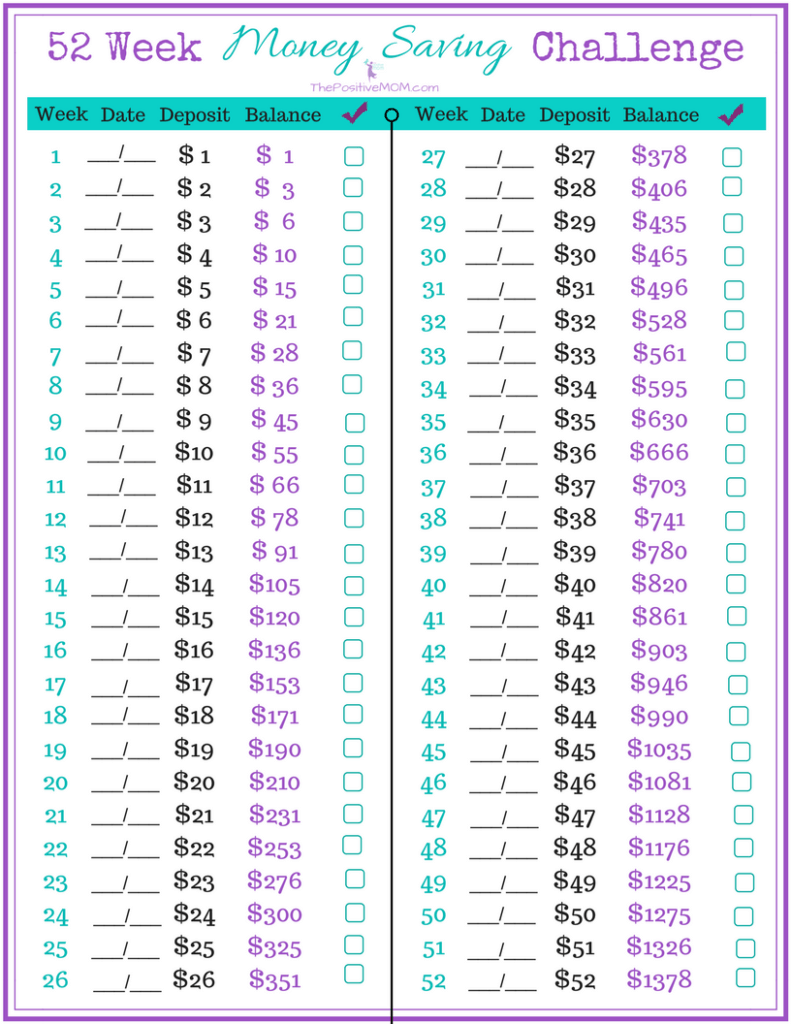

The 52-week money saving challenge is a great tool to get in the habit of saving and increase your emergency fund, no matter what your income level is.

You simply save $1 the first week, $2 the next, and so forth, for a total of $1378 at the end of the year mark.

Download your FREE 52-week Money Saving Challenge Printable HERE

Sometimes it helps to set it and forget it.

Research shows that one of the best ways to become a better saver is to put your savings plan on auto-pilot, to set up automatic, recurring monthly transfers to your emergency fund.

Remember to save more when you get more. Whether it’s a cash gift, a tax refund, or even a raise at work, make sure you seize that opportunity to make your emergency fund grow.

Are you building an emergency fund? It’s so empowering to know we can be proactive to get further ahead in our journey to our personal financial freedom and to building a legacy for our family. Share your tips and stories with us below.

Elayna is a single mom of 4, award-winning Storyteller, Story Strategist, and Student of Pain. She’s a bestselling author, internationally acclaimed keynote speaker, and 4x TEDx speaker. Founder of the Positive MOM® and creator of the S.T.O.R.Y. System: a blueprint to craft and share powerful stories that will transform your results, so you can have the wealth, opportunities, and freedom you deserve. Connect with Elayna Fernández at thepositivemom.com/keynote-speaker and follow @thepositivemom. To receive a gift from Elayna, click HERE.

Want to support the Positive MOM blog?

The mission of the Positive MOM blog is to help moms break trauma cycles, find peace, and feel emotionally whole, so they can practice supportive parenting and create a positive and healthy environment for their children. If you found Elayna’s content valuable, please consider donating a love offering to enable her to keep creating content and helping more moms worldwide. Donate HERE.

It's Time To Learn How To Secure Your Financial Future ~ #OwnYourFuture

Sunday 27th of December 2020

[…] wore my Prudential blue, put on the Pru necklace we received as Prudential Brand Ambassadors at DiMe Summit, and I went to the Prudential booth/lounge area to have a make-up artist get me photo-ready and […]

Vanessa

Wednesday 27th of June 2018

One of my goals is to build one for myself. We do have a family one, but I don't want to depend on that, so thanks for the reminder. Definitely will start to track my spending more.

A Man Is NOT A Plan - Becoming a Financially Empowered Mom ★ Elayna Fernandez ~ The Positive MOM ♥

Wednesday 2nd of August 2017

[…] and couldn’t travel or take as much work as I had in the past. Thankfully, I had no debt, I had savings, and I had empowered myself to know how money works and to make it work for me so I could keep my […]

It's Time To Learn How To Secure Your Financial Future ~ #OwnYourFuture ★ Elayna Fernandez ~ The Positive MOM ♥

Monday 5th of June 2017

[…] wore my Prudential blue, put on the Pru necklace we received as Prudential Brand Ambassadors at DiMe Summit, and I went to the Prudential booth/lounge area to have a make-up artist get me photo-ready and […]

Dania Santana

Wednesday 24th of May 2017

Getting into the habit of saving is something I'm currently working on; that wasn't something that I learned as a child but that I definitely want to teach my children so they don't struggle in the future. I've been on the "i want to pay off debt first" track for a long time, but I see how important is to have savings. Thank you for the savings challenge, it's going to be a great way for me to keep at it and make it a habit!